Tata Coffee Limited

- Romik Rai

- Jan 18, 2020

- 5 min read

Updated: Jun 11, 2025

NSE Code: TATACOFFEE BSE Code: 532301

ISIN INE493A01027 Market Cap (Rs. Cr) 1,856

Tata Coffee is the largest integrated Coffee cultivation and processing company in the world and the largest corporate producer of Indian Origin Pepper. With the utmost emphasis on sustainability and traceability, they produce some of the finest Indian Origin Green Coffee Bean, Instant Coffee, Pepper and Tea. Their 19 estates are spread over nearly 8,000 hectares in the lush Western Ghats, flourished with a plethora of flora and fauna. Being one of the leading players in the B2B Instant Coffee industry, their assets include plants at Toopran (Telangana) and Theni (Tamil Nadu) and from March 2019 onwards a 5000 MTP in Vietnam, the world's second largest coffee producing nation . These plants produce Freeze Dried, Agglomerated, Spray Dried Coffees and other coffee mixes. Tata Coffee also produces some of the finest Indian Origin Pepper, intercropped amongst their Coffee estates. Along with these, their tea estates and factories in the Anamallai region also produce certified Orthodox and CTC Teas.

Tata supplies coffee beans to over 100-odd Starbucks outlets in India and is now also looking to become a supplier of coffee for the Seattle-based company globally. The company recently started retailing its single estate coffees at Starbucks outlets in the USA and has broken down its 8,000 hectares of plantation into over 800 micro-blocks. These are now managed at a micro level keeping in mind the condition of the soil, climate and foliage. This is being done to integrate into Starbucks vertical integration model to ensure the quality of the beans and that they are grown ethically.

BUSINESS OUTLOOK

The company's financial performance has been subdued for the past 2 years due to the capex being incurred in setting up the new 5000 MTP plant in Vietnam. With this plant coming on stream in 2019 the company expects the plant to operate at 70% capacity in FY20 and reach 100% capacity utilization in FY21.

In light of this the financial outlook for the next few years looks good with lower capex planned and additional production coming on stream. We expect the the company to report lifetime high turnover and profits this year and grow both by at least 15% in the following year.

ENVIRONMENTAL IMPACT

Tata Coffee's estates are home to over 3,000 natives species of flora and nearly 496 native species of animals. Coffee is inter-cropped with other crops like pepper, oranges and areca nuts amidst lush canopies of shade trees to help preserve biodiversity. Their Wildlife Cell mitigates the human-elephant conflict in neighbouring areas, helping to maintain a healthy co-existence between wildlife and their communities.

All of their 19 estates are Rainforest Alliance, UTZ and SA8000 certified and a major share of the power utilised in the Theni Instant Coffee plant is derived from renewable sources.

At negative 1.71 lakhs tonnes of CO2 equivalent emmissions per annum, their estates are an invaluable carbon sink providing essential air purification to both states of Telangana and Tamil Nadu.

SOCIAL IMPACT

Tata Coffee's practices are among the best in the industry when it comes to training and safety of their workers. They provide healthcare provisions, hygienic accommodation facilities along with crèche facilities for all workers’ children. The have internationally recognised safety practices for mitigating threats from wildlife in the estates, working at heights, working with chemicals and with machinery. They also conduct training sessions in communication, language development and basic computing & accounting to help the rural women enhance and learn new skills. With thier 'Recognition of Prior Learning Programme', they help the women match their career experience with qualification along with self-development training programs to increase their chances of employment. In communities around the estates, they run and support the Girl Child Nutrition Programme and several other women's self-help groups have been formed for their overall development.

Further, they support the Coorg Foundation in its mission to promote education and healthcare for the underprivileged of the Coorg region. The foundation operates the Swastha Center for Special Education and Rehabilitation, aimed at differently-abled children to help them reintegrate into the mainstream society. In Anamallais, they support the developmental activities of the differently-abled children through DARE (Developmental Activities for Rehabilitative Education). They also provide affordable healthcare and make it accessible through their Rural Indian Health Project Hospital. This initiative takes healthcare right into Coorg's remote hilly regions through mobile clinics.

TECHNICAL VIEW

After make a high of Rs.178 in November 2017 the stock was in a downtrend for 2 years registering a low of Rs.67 in August 2019. In January 2020, the stock has crossed over a big hurdle of resistance placed at Rs.100 for the first time since January 2019 and registered a new 52 wk high of Rs.104 on 16 January. The stock appears to have started a new uptrend and target of 178 and then 300 can be expected over to 3 years if the uptrend continues. Strict violation of the uptrend would be confirmed if the stock closes below Rs.89.

SUMMARY

Given Tata Coffee Limited's leadership position in the evergreen Coffee, Tea and Pepper plantations business, its high intrinsic value and low valuation, the stock at Rs.99 is an investment worth considering. The company has low debt (which is expected to reduce further now that the new plant in Vietnam has been commissioned), pays a steady dividend and its products are virtually assured of growing global demand. One significant risk is international competition from Brazil which may affect American markets, however, growth in demand from the EU and South East Asia will most likely augur well for the future prospects of Tata Coffee Limited.

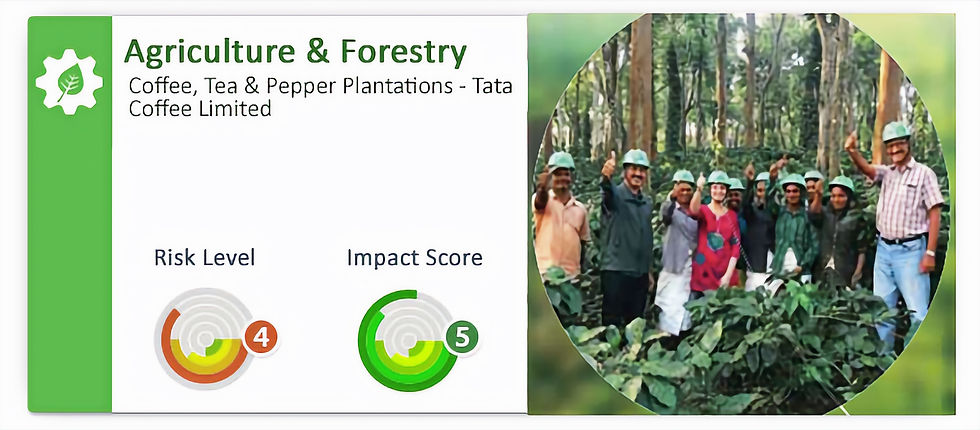

Greenassets.in assigns this investment a risk rating of 4 - HIGH RISK. Loss of capital is possible with equity ownership. Detailed analysis and monitoring is key to managing risks successfully.

With their plantations providing an invaluable carbon sink to South India, their focus on sustainable forestry, bio-diversity preservation, water conservation and use of renewable energy, Tata Coffee Limited deserves an E-Score of 10/10.

Being an international supplier with a fast expanding global presence, ethically cultivated produce from Tata Coffee's plantations reach millions of people across the Americas', Africa, Europe & Asia. Their commitment to providing world class training, healthcare and education to their employees is also to the best standards in the industry. The Social Impact of this investment is thus maximum, deserving a score of 10/10.

Please write to us to understand and debate the scoring systems of our featured investments. We are always happy to receive feedback on our stated opinion.

DISCLAIMER - THIS ARTICLE IS NOT INVESTMENT ADVICE AND HAS BEEN WRITTEN TO HIGHLIGHT THE POSITIVE ENVIRONMENTAL & SOCIAL IMPACT OF THE BUSINESS DISCUSSED.

Market cap of Tata Coffee now exceeds 4,000 Cr. and this investment into a sustainable business has turned into a multibagger. Expect steady compounding here for years to come. A true coffee can investment.

Nice information